UK Landlords Survey Analysis Reveals Lack Of Knowledge Amongst Landlords

The UK 2018 Survey for landlord was released early this yea and there a few interesting findings we wanted to dive into and share with you. Landlords play a crucial role in providing homes, both now and in the future, yet very little is known about them until these survey releases. Below are some of Open House Estate Agent’s findings.

The Private Rented Sector Is The Second Largest Sector

Since the last Private Landlords Survey (PLS) was undertaken in 2010, the private rented sector has undergone substantial growth and change. The number of households in the sector rose by 25% between 2010-11 and 2017- 18, from 3.6 million to 4.5 million households. The private rented sector is now the second largest tenure in England, and is home to a fifth of all households.

The private rented sector is characterised by diversity, containing a wide range of different sub-markets, serving a wide range of different types of households across all incomes, including an increasing number of families. In 2017-18, 35% of households in the private rented sector included dependent children (1.6 million households, up 37% from 1.1 million in 2010- 11). There are high rates of turnover in the private rented sector, with the number of house moves significantly higher than in the owner occupied and social rented sectors, both within the sector and between it and the other sectors.

Key Changes Since The Last Landlords Survey

Since 2010, there have also been a number of policy changes affecting private landlords. These include tax changes for Buy to Let landlords, changes to the Stamp Duty Land Tax, tightening lending criteria on Buy to Let mortgages and the growing role of the Build to Rent sector. These changes were made as part of the government’s wider efforts to make the housing market work for everyone and to ensure the housing market delivers the homes the nation needs.

Landlord Insights

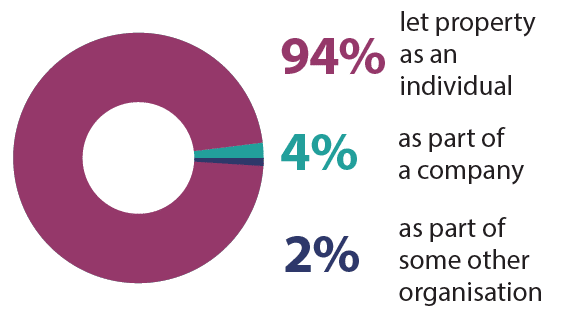

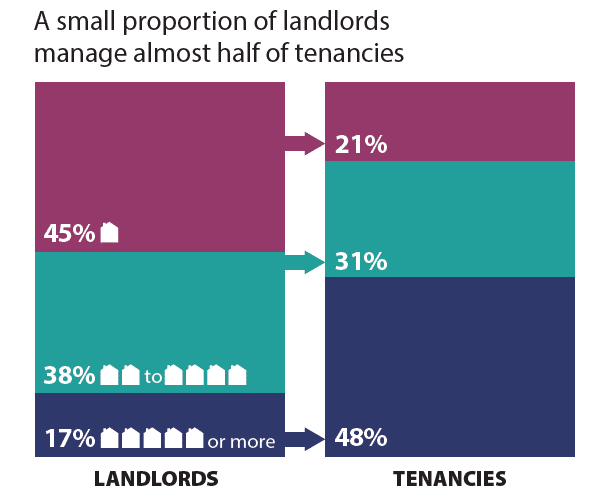

With 94% of landlords rent property as an individual, 4% as part of a company and only 2% as part of some other organisation. Whilst almost half of landlords own just one property, half of private rented sector tenancies are let by the 17% of landlords with five or more properties. Interestingly, Landlords are on average, older and less ethnically diverse than the general population. Most have been landlords for some time, 70% of landlords have let property for 6 years or more. The average length of time that landlords had let property was 11.5 years. Furthermore, Landlords who had been letting for longer were more likely to have used a mortgage to fund their first rental property and more likely to currently use a Buy to Let mortgage compared to more recent landlords.

What About The Future?

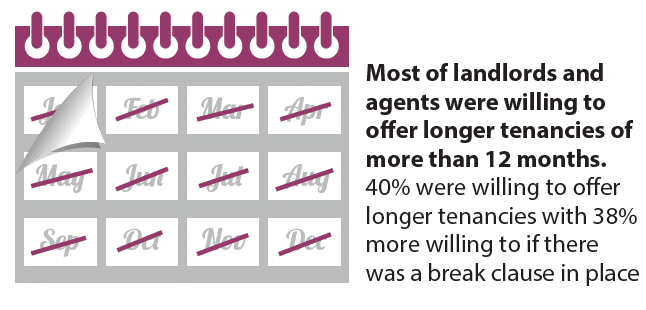

There looks to be change in the length of tenancies. With three quarters of landlords and agents willing to offer longer tenancies of more than 12 months. Landlords and agents were asked what would encourage them to offer longer tenancies and they reported they would if it was easier to remove problem tenants (70%).

Use Of Estate Agents

Landlords were asked whether they currently used an agent to let or manage their properties. Just over half (52%) said they did not use an agent. A third (34%) used an agent for letting services, with one in ten (9%) using an agent for both letting and management services. The remaining 5% only used an agent for management services.

More recent landlords were less likely to use an agent than longer standing landlords. A third (32%) of those who had been a landlord for three years or less were currently using an agent, while that proportion increased to almost half (46%) amongst those who had been a landlord for between four and 10 years and to over half (53%) amongst those who had been one for 11 or more years.

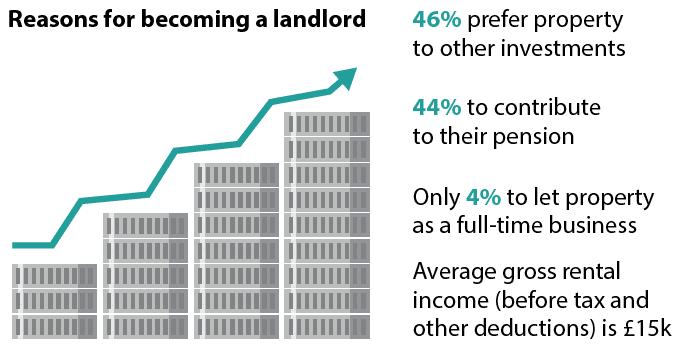

Economic Activities and Income

In 2018, 29% of landlords were employed full-time and 11% part-time. A third (33%) of landlords were retired. Less than a fifth (16%) of landlords were self-employed (not as landlord), with a further 13% self-employed as a landlord. Over half of tenancies were represented either by landlords who were retired (28%) or those self-employed as a landlord (30%).

On average, landlords received two fifths (42%) of their total gross income from rental property. A quarter (26%) of landlords received up to a quarter of their gross annual income from rents. A further 45% received more than a quarter and up to half of their income from rental property. Thus, showing how profitable property investment can be.

What About The Tenants?

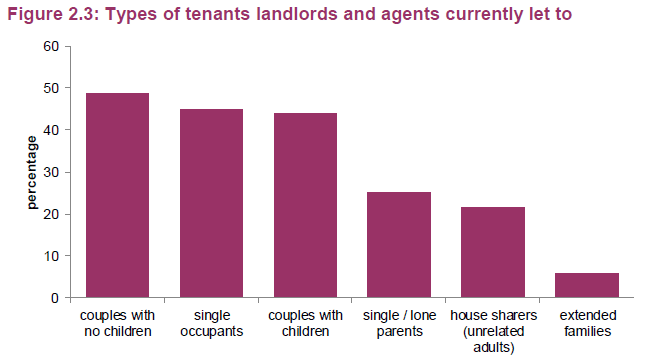

The most common types of tenants that landlords and agents currently let to are couples without dependent children (49%), single occupants (45%) and couple with dependent children (44%). Relatively fewer landlords and agents reported letting to lone parents (25%), house sharers (22%) or extended families (6%), Figure 2.3. The distribution of types of tenants is largely similar to that reported in the EHS.

There are so many interesting findings, facts and figures in the full landlord survey report, check it out here.

Want To Become A Landlord And Join The Hype?

Open House Letting Agent Leicester offer unrivalled experience of the Leicester lettings market. Rest assured you will receive the best local expertise to help you achieve your property investment goals. We have access to a national database of prospective tenants searching for properties in your area and a strong presence on the major property portals.

Landlords are often concerned about the quality of their tenants – an undesirable tenant can be more trouble than they are worth. Our letting agent experts carry out thorough checks to ensure that any tenant we find for you is of good standing.

Contact us today for a free rental valuation, or give us a call on 0116 243 7938 and speak to a friendly local advisor today to find out how other Leicester landlords are increasing their rental yield.